Register now or log in to join your professional community.

True or False?

false/ because the capital earning ratio measure earning share but the ratio that measure range of company depend on external financing is debit ratio.

False , Because Capital gearing ratio shows a relation between shareholder's fund and lender's fund. It does not concentrated only on shareholder portion.

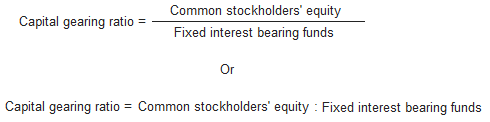

What Capital Gearing Stands for :- Analyzing capital structure means measuring the relationship between the funds provided by common stockholders and the funds provided by those who receive a periodic interest or dividend at a fixed rate.

Crux is :-

Highly geared>>>Less common stockholders’ equity

Low geared>>>More common stockholders’ equity

Do you need help in adding the right keywords to your CV? Let our CV writing experts help you.